What is a general ledger and why is it important? To find out read on!

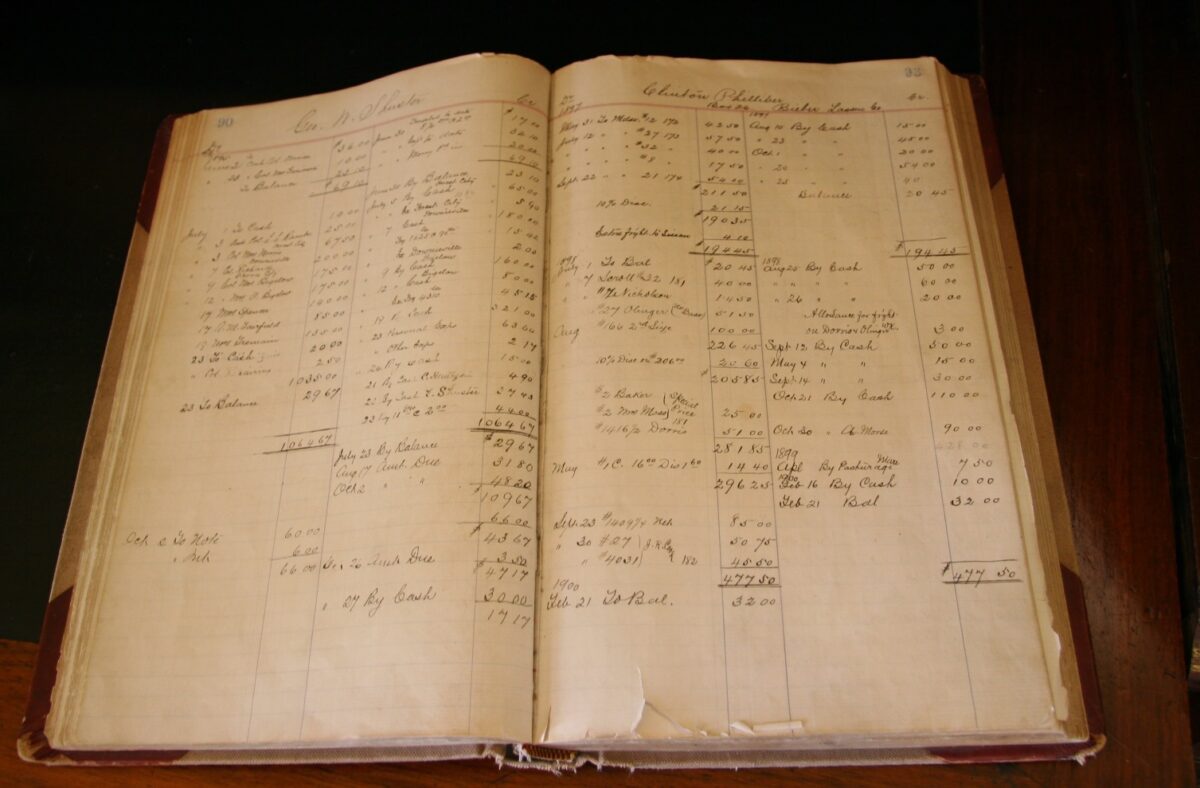

What is a general ledger? A general ledger is a log of all the transactions relating to assets, liabilities, owners’ equity, revenue and expenses. It’s how a company can tell if it’s profitable or it’s taking a loss. In the US, this is the most common way to track the financials.

To understand how a general ledger works, you must understand double entry bookkeeping. So, what is double entry bookkeeping? I’m glad you asked. Imagine you have a company and your first customer paid you $1000. To record this, you add this transaction to the general ledger. Two entries made: a debit, increasing the value of your assets in your cash account and a credit, decreasing the value of the revenue (money given to you by your customer payment). Think of the cash account as an internal account, meaning an account that you track the debits (increasing in value) and credits (decreasing in value). The revenue account is an external account. Meaning you only track the credit entries. External accounts don’t impact your business. They merely tell you where the money is coming from and where it’s going.

Here is a visual of our first customers payment.

If the sum of the debit column and the sum of the credit column don’t equal each other, then there is an error in the general ledger. When both sides equal each other the books are said to be balanced. You want balanced books.

Let’s look at a slightly more complex example.

You receive two bills: water and electric, both for $50. You pay them using part of the cash in your cash account. The current balance is $1000. What entries are needed? Take your time. I’ll wait.

Four entries are added to the general ledger: two credit entries for cash and one entry for each the water and electric accounts. Notice the cash entries are for credits.

For bonus, how would we calculate the remaining balance of the cash account? Take your time. Again, I’ll wait for you.

To get the remaining balance we need to identify each cash entry.

To get the balance of the Cash account we do the same thing we did to balance the books, but this time we only look at the cash account. We take the sum of the debit column for the cash account and the sum of the Credit column for the cash account and subtract them from each other. The remaining value is the balance of the cash account.

And that folks, is the basics of a general ledger and double entry bookkeeping. I hope you see the importance of this approach. As it give you the ability to quicking see if there are errors in your books. You have high fidelity in tracking payments and revenues.

This is just the tip of the iceberg in accounting. If you’d like to dive deeper into accounting, have a look at the accounting equation: Assets = Liabilities + Owner’s Equity.

Hopefully this post has given you a basic understanding of what a general ledger is and how double-entry bookkeeping works. In the next post I’ll go into how to implement a general ledger in C#.